In today's digital age, where convenience and efficiency reign supreme, traditional address verification methods are rapidly becoming obsolete. Enter Electronic...

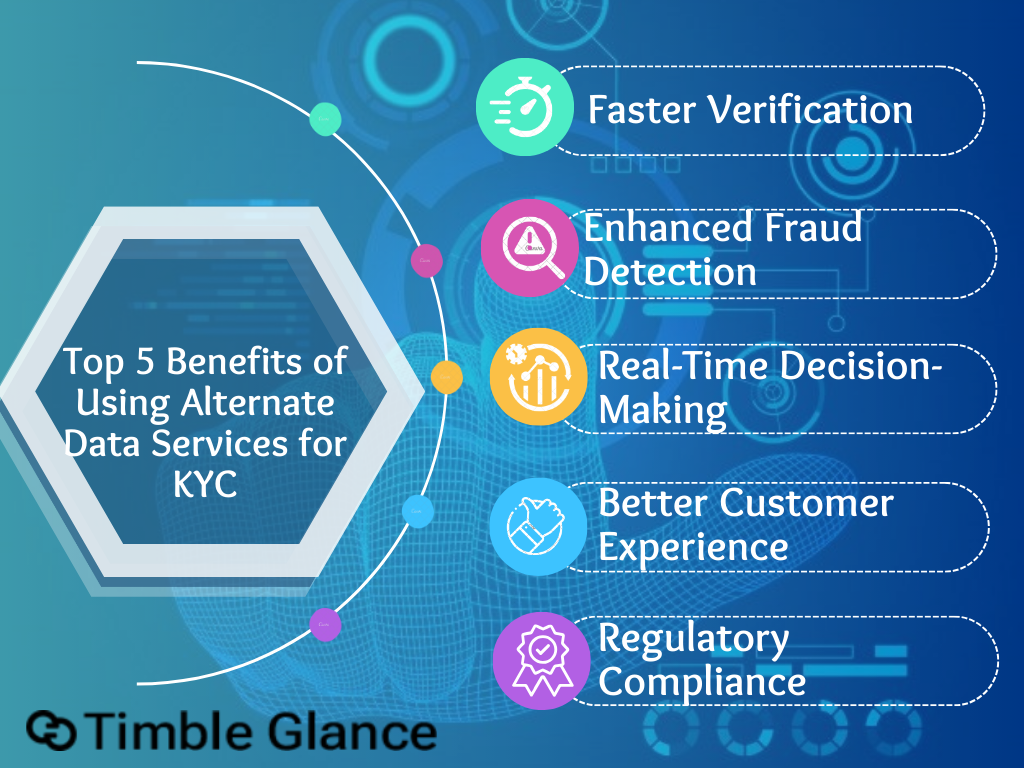

Top 5 Benefits of Using Alternate Data Services for KYC in 2024

Post Details

Introduction:

In 2024, the financial industry faces increasing pressure to meet stringent Know Your Customer (KYC) requirements while combating evolving fraud threats. Traditional KYC methods are no longer enough. Timble Glance steps in with innovative alternate data services, offering financial institutions the tools they need to verify customer identities quickly, accurately, and securely. By tapping into unconventional data sources—such as utility bills, social data, and digital footprints—institutions can streamline KYC processes, mitigate risk, and enhance security. Here are the five key benefits of using alternate data services for KYC and how Timble Glance is leading the way.

1. Faster Verification

Speed is critical in today's fast-paced digital economy. Customers expect seamless service, and delays in KYC processes can lead to frustration and lost business. Alternate data services dramatically reduce onboarding times by leveraging real-time sources such as utility bills and social media profiles, enabling institutions to verify customer identities within minutes instead of days. Our solutions are designed to help financial institutions meet customer expectations by providing quick, hassle-free verification.

2. Enhanced Fraud Detection

Fraudsters are becoming more sophisticated, making traditional KYC methods vulnerable to exploitation. Enhanced fraud detection capabilities are achieved by using alternate data services that cross-check customer information from multiple real-time sources. Our services offer a robust defense against identity theft, document forgery, and other types of fraud.

With the help of our advanced KYC services, you can stay one step ahead of fraudsters. Our real-time data solutions flag suspicious activities early, allowing institutions to prevent fraud before it escalates. With us, your organization gains peace of mind, knowing you have a powerful tool to safeguard your business from fraud.

3. Real-Time Decision-Making

We understand that having access to real-time data is essential for financial institutions to make informed decisions quickly. Outdated data can lead to misjudgments and missed opportunities, but our alternate data services provide up-to-date customer information, enabling you to make smarter decisions in real time.

Whether you’re assessing loan approvals, onboarding customers, or managing risk, our KYC solutions ensure that your business is always working with the most accurate and timely data. With our solutions, you’ll have the confidence to make decisions faster and more effectively, reducing operational delays and maximizing efficiency.

4. Better Customer Experience

Providing a seamless customer experience is crucial in today’s competitive market. The longer a customer waits for verification, the higher the likelihood they’ll switch to a competitor. We understand the importance of frictionless onboarding. Our alternate data services eliminate the need for extensive paperwork and long wait times, delivering fast, user-friendly verification.

5. Regulatory Compliance

Regulatory compliance is non-negotiable for financial institutions. Non-compliance with KYC and Anti-Money Laundering (AML) regulations can result in hefty fines and reputational damage. We ensure that your institution meets all regulatory requirements by offering alternate data services designed with compliance at the forefront.

Conclusion:

As we move into 2024, Timble Glance is at the forefront of KYC innovation, offering solutions that leverage alternate data services to transform how financial institutions verify customers. Our services deliver speed, enhanced fraud detection, real-time decision-making, improved customer experience, and guaranteed compliance.

We’re committed to empowering financial institutions with cutting-edge solutions that not only optimize KYC processes but also protect your organization from fraud and ensure regulatory compliance. Our approach is designed to help you stay ahead of the curve in a rapidly evolving fintech landscape, making KYC faster, more efficient, and more secure.

Subscribe To Our Newsletter

Get Updates And Learn From The Best

By submitting this form, I confirm that I have read and understood Timble Glance’s Privacy Statement.

Related Articles

Intelligent Document Recognition (IDR) represents an advanced technological solution employing artificial intelligence (AI) and machine learning (ML)...

In the fast-paced world of financial services, making quick and accurate creditworthiness assessments is crucial for the success of lending institutions. Traditionally...